Any company operating in international markets will face a multitude of risks. Acknowledging these risks and devising a strategy for how to deal with these risks is a prerequisite for survival in today’s competitive market. Assuming that the task to come up with a new strategy implies that the old strategy has outlived itself or at least has proven itself wrong on too many occasions, the stage is now set for a new approach. This paper will first present the main risks that are facing any company. Then, the available options to reduce these risks will be considered. Finally, in relation to these risks, flexibility and robustness will be introduced as a tool to handle uncertainties (risks).

Any company operating in international markets will face a multitude of risks. Acknowledging these risks and devising a strategy for how to deal with these risks is a prerequisite for survival in today’s competitive market. Assuming that the task to come up with a new strategy implies that the old strategy has outlived itself or at least has proven itself wrong on too many occasions, the stage is now set for a new approach. This paper will first present the main risks that are facing any company. Then, the available options to reduce these risks will be considered. Finally, in relation to these risks, flexibility and robustness will be introduced as a tool to handle uncertainties (risks).

Note: This paper has been updated in these later posts, where the framework has been further refined:

husdal.com: Robustness, resilience and flexibility in the supply chain (2008)

husdal.com: Robustness, resilience, flexibility and agility (2009)

husdal.com: Robust, Flexible, Agile, Resilient. What does it mean? (2015)

Introduction and outline

Any company operating in international markets will face a multitude of risks. Acknowledging these risks and devising a strategy for how to deal with these risks is a prerequisite for survival in today’s competitive market. Assuming that the task to come up with a new strategy implies that the old strategy has outlived itself or at least has proven itself wrong on too many occasions, the stage is now set for a new approach. This chapter first will present the main risks that are facing the company. Then, the available options to reduce the risk will be considered. Finally, in relation these risks, flexibility and robustness will be introduced as a tool to handle uncertainties (risks).

What are the main risks facing the company?

The main risk facing any company is the stochasticity, i.e. the randomness, of the real world. This implies that regardless of any meticulously laid plans for the future, this future will always be uncertain, and no plan will be able to guarantee a certain outcome. Uncertainty takes on many forms: a rise or fall in the raw material prices due to shortages or surpluses, uncertain lead times, uncertain government constellations, and hence regulations in foreign countries, breakdown or failure of a major production facilities, labour union issues and last but not least, the known and the yet unknown competitors, to name but a few. These are just some of the risks which must be considered, as is highlighted by the following, which is not meant be an exhaustive list.

Production and manufacturing

If, say, the company employs a production facility in Norway and one in the Far East (China), the production costs per unit in terms of labour and raw material will differ considerably between these two plants. Global, regional and local market fluctuations can and will affect productivity and cost-effectiveness at both locations. Health and safety and environment regulations may change; the same applies to government regulations and taxation schemes. New production methods and modes may arise which the plant cannot cater for. Especially in the Far East, competitors may be able to produce similar goods at lower cost.

New locations

The issues that already affect the current production facilities are even more uncertain when considering potential new locations. The same issues as above apply here, too.

Inventory

Maintaining an inventory that adapts flawlessly to consumer demand is challenging, since demand, albeit calculable and to some degree directable through marketing efforts, in essence is a stochastic variable.

Transport and inventory are closely knit, and preferably, most of the inventory should always be “on wheels”, that is, on its way to the end customer rather than occupying costly space at a warehouse. Finding the optimal solution for demand, inventory and transport is challenging and changes constantly.

Demand may be uncertain; supply, however, should not be. The biggest risks here are breaches of contract and currency exchange fluctuations. The latter impacts the cash flow, the former may have a sever impact on business reputation.

How to meet risk and uncertainty

Robustness and flexibility are tools for meeting uncertainty, and robustness analysis is a way of supporting decision making when there is uncertainty about the future (Rosenhead, 2002). Robustness is the ability to accommodate any uncertain future events or unexpected developments such that the initially desired future state can still be reached. Flexibility is the ability to defer, abandon, expand, or contract any investment towards the desired goal. Flexibility and robustness are two sides of the same coin, yet at the same time two distinctively different animals. Being robust does not necessarily entail being flexible and being flexible does not necessarily entail being robust. If robustness can be compared to how you dress to meet different weather conditions, then flexibility can be compared to your ability to switch between walking, running, cycling, driving your car, or whichever mode of transport you choose. As Ku (1995) puts it, flexibility is the inherent capability to modify a policy to accommodate and successfully adapt to such changes, whereas robustness refers to the ability to endure such changes.

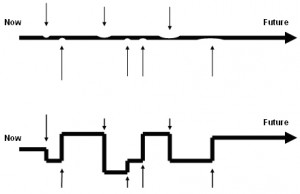

Figure 1: The principal difference between robustness and flexibility.

Robustness (above) means the ability to stay on course and to accommodate unforeseen external events (indicated by arrows). Flexibility (below) means the ability to accommodate unforeseen external events by changing tracks while being open to deviate from the initial course.

Figure 1 illustrates the terms robustness and flexibility. Robustness means the ability to stay on course and to accommodate unforeseen contingent events. Flexibility means the ability to accommodate unforeseen external events by changing tracks and being open to deviate from the initial course. In reality no strategy should be built on pure robustness or pure flexibility, but should be a merger of both.

Making decisions when faced with uncertainties is a difficult task. The following is a description of some of the tools that are available for decision support. Again, it is not an exhaustive list, merely a shortlist of the most used methods.

Scenario analysis

One way to handle uncertainties is to use scenario analysis, applying the concept of expected values. This turns stochastic variables into deterministic parameters. One clear advantage of this method is that the outcome of a large number of possible inputs or decisions can be analysed. Using scenario analysis, the supposedly most likely, or most expected, future can be determined, and initial decisions made accordingly. The downside of scenario analysis is its inability to handle contingent decisions that arise within the scenario. So, once the scenario is determined, and decisions made, and the future starts running, there is practically no way of returning and making a different decision, certainly not without paying a hefty price. In addition, the most likely scenario may not be the optimal solution. However, scenario analysis does have its value, and it should not be discarded as useless, but it should be kept in mind that it is not able to foresee the future, no matter how much we wish for it to do so.

Net present value NPV

Based on the analysis of various scenarios, the future revenue streams related to these scenarios can be calculated and when discounted to their net present value, the scenario or decision with the highest net present value should be the preferred decision. This works fine as long as the scenario unfolds as planned, but fails miserably when faced with uncertainty. The supposedly most likely scenario is only most likely as longs as the inherent assumptions for the scenario hold, if they don’t, and one can never be sure that they actually do hold, the most likely scenario is a potential recipe for disaster. Another issue with using the net present value is setting the correct discount rate. If it is too high, only highly profitable projects will be considered, if it is too low, the portfolio of possible projects may become too large, or may not reflect the actual risk of undertaking these projects.

Option theory

Options in a sense seem to be the perfect answer to uncertainties. Originally developed for the pricing of options on financial assets, option-pricing theory is equally well suited for capital budgeting purposes. The reason is that many decisions are contingent on the outcomes of stochastic events, hence the similarity between financial options and real life options or real options. The theory of options is extensively covered in (Dixit and Pindyck, 1994), and prescribes optimal investment rules under uncertainty. Since flexibility in projects may have a substantial value and may constitute a significant contribution to the net present value, it is imperative to estimate the value of these flexibilities or options. For all practical purposes, the estimation of real options follows the estimations of financial options and is carried out in the same manner and beyond the scope of this paper.

Risk averse, risk neutral or risk seeking?

In scenario analysis, risk is accounted for by assuming that the most expected scenario actually will occur. In NP-assessments, risk can be accounted for by adjusting either the discount rate or the future cash flows, which both will affect the NPV. In options theory, risk is accounted for by valuing the opportunity cost of making a commitment now or postponing it. The value of an option that is given up (“killed”) is explicitly taken into account.

Regrettably, more often than not risk aversion is the common sense strategy for betting against an uncertain future. As a company, our risk is to a large extent carried by our shareholders, and being risk averse may inadvertently reduce shareholder value, since insurance implies that basically “nothing can go wrong”. However, risk aversion seldom generates higher revenue streams and almost never fosters innovation, which is the prerequisite for staying ahead in today’s market. In a robustness/flexibility setting, the risk averse decision maker would prefer robustness over flexibility. The risk taking decision maker would seek a high level of flexibility. Hence, it follows that a risk neutral decision maker would employ a sound mix of both robustness and flexibility. As Ku (1995) says, flexibility denotes immediate responsiveness while robustness provides an insurance or cushion against undesirable events (p. 409).

Flexibility and robustness as options to reduce risk

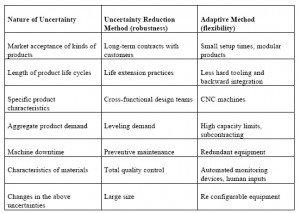

Flexibility and robustness should be seen as tools, or options if you so wish, in attitude towards risk. Figure 2, taken from Gerwin (1993), describes how robustness and flexibility can be used to reduce uncertainty or adapt to it. Note the distinction between reduction and adaptation that clarifies the difference between robustness and flexibility. Robustness reduces uncertainty because necessary steps are taken to minimise the (unwanted) effects of uncertainty. Flexibility does not minimise the effects per se, but (simply) adapts to it. Flexibility means the ability to change or react when necessary (Ku, 1995); robustness means the absence of a need to change or react (p. 413).

The following presents an overview of how robustness and flexibility can be put into use in the mentioned business areas, see also Bengtson (2001) and Olhager et a. (2002).

Figure 2: Using robustness and flexibility in reducing and adapting to uncertainty.

In: Ku (1995) – adapted from Gerwin (1993)

Production and manufacturing

With regard to the mentioned risks continuing to invest or upgrading one or both of the existing plants, shutting down one, or shutting down both and moving the production facilities to a new location. In addition, there may be the option of shutting down temporarily. Another option could involve changing the type of products produced, such that the high-cost factory serves the high-end market and the low-cost facility serves the mass market. Finally, there is also the possibility of installing re-configurable machinery such that new production lines can be set up easily.

New locations

Moving to new locations is risky. A whole new facility must be set up, including the logistics that need to go with it when production starts, both in terms of supplying raw materials, hiring workers, complying with new regulations and bringing finished products to the market. Several options should be explored, and strategies should be devised that allow for quick de-constructing and re-establishing of production facilities.

Inventory

Inventory uncertainty relates to uncertainties in demand and supply, producing over capacity at all costs is not an option. However, if lead times between facilities and/or warehouses are acceptably low, a flexible stocking system is probably better than a robust system that requires constant overstocking.

Transport

Reducing risks in transport will involve flexibility in fleet size/type and/or vehicle routing. A robust system is most likely too rigid and unable to respond quickly to changing demand.

Supplying and purchasing

To reduce the risks, several types of contracts must be sought, both long-term and short-term, that can be cancelled if conditions turn unfavourable, i.e. if the exchange rate suddenly drops and profits diminish. Applying forwards and futures is another method for securing a guaranteed future cash flow.

Conclusion

A strategy for robustness and flexibility must be inextricably linked to the strategies for all business areas, which need to contain measures of robustness and flexibility, and it is the interaction of the individual robustness and flexibility of these business areas that determines how robust and flexible we are as a company. Flexibility and robustness come at a cost. In any case, it must be determined whether flexibility or robustness is the better option.

References

Bengtson, J (2001) Manufacturing flexibility and real options: A review. International Journal of Production Economics, 74, pp.213-224. Elsevier Science.

Dixit, A K and Pindyck, R S (1994) Investment Under Uncertainty, Princeton University Press, Princeton NJ.

Gerwin, D (1993) Manufacturing Flexibility: A Strategic Perspective, Management. Science, Vol. 39, No. 4, April, pp. 395 – 410.

Ku, A (1995) Modelling Uncertainty in Electricity Capacity Planning. Unpublished PhD thesis. London Business School, London, UK. Available at www.analyticalq.com/thesis/ch6.pdf (Last accessed 10 Dec 2004).

Olhager J and West, M W (2202) The house of flexibility: using the QFD approach to deploy manufacturing flexibility. International Journal of Operations and Production Management, 22, 1, pp. 50-79.

Rosenhead, J (2002) Robustness Analysis. EWG-MCDA Newsletter, Series 3, No.6, Fall 2002 Available at www.inescc.pt/~ewgmcda/ForRosenh.html (Last accessed 10 Dec 2004).

Wallace, S W (2003) Decision making under uncertainty: The art of modelling. Unpublished course text. Molde University College, Molde, Norway.

Reference

Husdal, J. (2004) Flexibility and robustness as options to reduce risk and uncertainty. Unpublished working paper. Molde University College, Molde, Norway. Available online at https://husdal.com/2004/12/15/flexibility-and-robustness-as-options-to-reduce-risk-and-uncertainty/ (Last accessed on [date]).

Read online

Flexibility and Robustness as options to reduce uncertainty

Updates

This paper has been updated in these later posts, where the framework has been further refined:

- husdal.com: Robustness, resilience and flexibility in the supply chain (2008)

- husdal.com: Robustness, resilience, flexibility and agility (2009)

- husdal.com: Robust, Flexible, Agile, Resilient. What does it mean? (2015)