In my post on Hyper-optimization and supply chain vulnerability: an invisible global risk? I highlighted some of the issues in Global Risks 2008, a report prepared by the World Economic Forum. It is now frightening to see how true the predictions in this report were, in particular, how it predicted the current economic downturn. Maybe we should pay more attention to these reports?

In my post on Hyper-optimization and supply chain vulnerability: an invisible global risk? I highlighted some of the issues in Global Risks 2008, a report prepared by the World Economic Forum. It is now frightening to see how true the predictions in this report were, in particular, how it predicted the current economic downturn. Maybe we should pay more attention to these reports?

A dire prediction

The report said, in these words:

From a relatively positive picture of the stability of the world economy in early 2007, the world is entering 2008 under conditions of considerable economic uncertainty. The possibility of a US recession has undoubtedly increased, but there is considerable debate as to how this would impact global prosperity.

I don’t think there is much debate anymore. The impact is being felt worldwide, and has dominated the news headlines during the last weeks, each day revealing an ever-worsening picture of the crisis, even in my own country, where the Norwegian government today announced drastic measures.

The IMF to the rescue?

Even the International Monetary Fund IMF is now stepping up its actions. Normally, I associate the IMF as an institution that lends money to countries with balance of payments difficulties, i.e. low-income countries, where the money is being used especially for poverty reduction. If the IMF is stepping in to help the global economy, I reckon that things really are serious, serious enough to warrant this quote from the Global Risks 2008 report:

Should systemic financial risk lead to a serious deterioration in the world economy, the prospects for collaborative (risk) mitigation may be reversed on several fronts simultaneously as attention turns to more immediate concerns.

The biggest risk: Asset price collapse

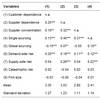

I should have seen it coming. The aforementioned report shows a risk matrix of the 26 core global risks, indicating their likelihood and their severity of impact. An “asset price collapse” is tanked as having more than 20% likelihood, and the impact is estimated at more than 1 trillion US$. Is that 1 trillion globally or 1 trillion in the US alone. The latter seems more true than the former these days.

I should have seen it coming. The aforementioned report shows a risk matrix of the 26 core global risks, indicating their likelihood and their severity of impact. An “asset price collapse” is tanked as having more than 20% likelihood, and the impact is estimated at more than 1 trillion US$. Is that 1 trillion globally or 1 trillion in the US alone. The latter seems more true than the former these days.

I can only hope that the global financial turmoil does not translate into a global supply chain turmoil. Considering how interwoven supply chains are, it is not unlikely that some companies will experience a collapse in their supply chain as a result of financial instability.

Link

- 3E Intelligence: Another Cassandra call? WEF’s pessimistic outlook for 2008