Can strategic alliances really work? In Trust, Control and Risk in Strategic Alliances, Das & Teng (2001) propose a new integrated framework for these three constructs in the context of strategic alliances. A strategic alliance is a form of cooperation and all forms of cooperation are wrought with risk, as yesterday’s article on why all businesses are snakes shows. Das and Teng develop a framework to address this risk, show what forms of control are available and discuss how trust can evolve.

Can strategic alliances really work? In Trust, Control and Risk in Strategic Alliances, Das & Teng (2001) propose a new integrated framework for these three constructs in the context of strategic alliances. A strategic alliance is a form of cooperation and all forms of cooperation are wrought with risk, as yesterday’s article on why all businesses are snakes shows. Das and Teng develop a framework to address this risk, show what forms of control are available and discuss how trust can evolve.

Strategic alliance – a form of cooperation

On a sidenote, the book Cooperative Strategy (which I have reviewed previously) lists six reasons why firms seek to establish cooperative networks: 1) certainty – by developing relationships with mutual solidarity, 2) flexibility – by being able to quickly allocate a range of resources, 3) capacity – by “outsourcing” work to other network members, 4) speed – by being able to quickly respond to a wide range of business opportunities, 5) skills and competence – by gaining access to resources other than one’s own, and 6) intelligence – by sharing market information. Placing cooperative networks on a scale, going from independent to integrated, the book describes five degrees of networks: 1) Equal-partner network, 2) Unilateral agreements, 3) Dominated network, 4) Virtual corporation, and 5) Strategic alliance. Now, what about Das & Teng?

Risk in Strategic Alliances

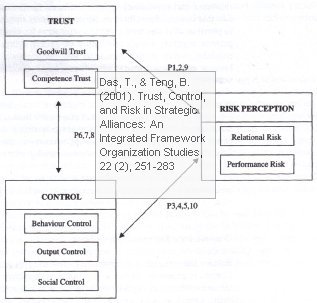

Risk perception and risk management are important subjects in management and strategy studies. Alliances are inherently a risky strategy, since the failure rate of alliances is higher than that of a single firm. Das and Teng differentiate between two forms of risk: 1) relational risk – the probability and consequences of not having satisfactory cooperation, and 2) performance risk – the probability and consequences that alliance objectives are not achieved.

Trust in Strategic Alliances

Trust is a multilevel phenomenon that exists at the personal, organizational, and interorganizational level. Trust is a key element in cooperative relationships, since it can be viewed as a positive expectation regarding another’s goodwill. Similar to risk, trust is divided into two dimensions: 1) goodwill trust – faith in each other, in each other’s good intentions and in each other’s integrity, and 2) competence trust – the sense of confidence that the partner is capable of accomplishing the given tasks in an alliance.

Control in Strategic Alliances

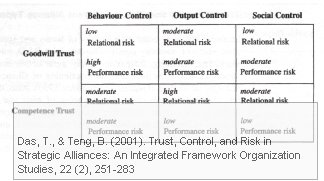

An alliance, regardless of how cooperative and trustful it is, needs a set of rules and formal measures of control. Das & Teng use three forms of control: 1) output control – measuring outcomes 2) behaviour control – turning appropropriate behaviour into desired output, aka process control, and 3) social control – establishing a common culture and values.

Propositions

The dimensions of trust, control and risk are then interlinked with a total of 12 propositions:

Copyright note: The figure above is taken from the article.

- Goodwill trust reduces perceived relational risk but not perceived performance risk

- Competence trust reduces perceived performance risk but not perceived relationship risk

- Perceived relational risk is reduced more by behaviour control than by output control

- Perceived performance risk is reduced more by output control than by behaviour control

- Social control reduces both perceived relational risk and perceived performance risk

- Output control and behaviour control undermine goodwill trust and competence trust

- Social control enhances both goodwill trust and competence trust

- Goodwill trust and competence trust enhances output, behaviour, and social control

- The lower the accepted relational risk level, the higher is the needed goodwill trust level

- The lower the accepted performance risk level, the higher is the needed competence trust level

- The lower the accepted relational risk level, the higher is the needed behaviour and social control

- The lower the accepted performance risk level, the higher is the needed output and social control

How this works is illustrated in the figure below. Here, a firm A is applying goodwill trust or competence trust in combination with behaviour, output and social control. The boxes indicate the effect this has on the level of relational or performance risk. Among other thing, it can be seen that social control has the overall best effect on reducing both relational and performance risk, while output and behaviour control work differently with goodwill than with competence trust.

Copyright note: The figure above is taken from the article.

Conclusion

This is a very interesting paper, putting trust, control and risk in perspective, showing how these terms are interlinked and how risk reduction can be approached in a comprehensive and systematic manner.

Reference

Das, T., & Teng, B. (2001). Trust, Control, and Risk in Strategic Alliances: An Integrated Framework Organization Studies, 22 (2), 251-283 DOI: 10.1177/0170840601222004

Links

- Zicklin School of Business: T.K. Das

- George Washington University: Bing-Sheng Teng