An intriguing title caught my eye today. Supply chain risk in turbulent environments – A conceptual model for managing supply chain network risk by Peter Trkman and Kevin Mc Cormack. This is the first time I have encountered the term turbulent environments in my research on supply chain risk, so I decided to take a closer look at it. What is it really…simply old wine in new bottles or something profoundly new?

An intriguing title caught my eye today. Supply chain risk in turbulent environments – A conceptual model for managing supply chain network risk by Peter Trkman and Kevin Mc Cormack. This is the first time I have encountered the term turbulent environments in my research on supply chain risk, so I decided to take a closer look at it. What is it really…simply old wine in new bottles or something profoundly new?

Inside and outside the supply chain

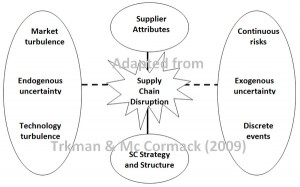

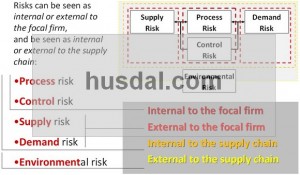

The authors lament that earlier research often neglects an important division of risk, namely the origin of risks, which can be either within the chain or from the outside environment. Hence they divide risk into two constructs, exogenous and endogenous:

Endogenous uncertainty: The source of uncertainty/risk is inside the SC and can lead to changing relationships between focal firm and suppliers

Exogenous uncertainty: The source of uncertainty/risk is from outside the SC.

The division in external and internal and naming it exogenous and endogenous is a fresh new approach. However, that earlier research neglects the origin of risk is a contention I cannot agree with. I can think of several central pieces of supply chain risk literature where this is explicitly not the case. Supply Chain Risk Management in Christopher (2005) and Supply chain risk management: outlining an agenda for future research by Jüttner, Peck & Christopher, M. (2003) divide risks into internal and external risks:

Click image for larger version. Adapted from Christopher (2005)

Click image for larger version. Adapted from Christopher (2005)

Internal: market and technology turbulence

Internal to the supply supply chain are market and technology turbulence. Market turbulence arises from the heterogeneity of the market, and the resulting rapid changes in customer composition and thus, customer preferences. Technology turbulence refers to the degree to which technology changes over time within an industry, in production as well as in the product itself.

External: Continuous risk and discrete events

Trkman and Mc Cormack use a novel approach when classifying exogenous uncertainty: discrete and continuous, encompassing both the distribution and the probability of impact

Continuous risk: Events where the costs of potential changes are continuous in nature and relatively easy to predict.

Discrete events: This category consists of low-likelihood, high-impact events.

Interestingly, only financial risks are noted as continuous risks (interest rates, changes in consumer prices, changes in GDP, and changes in commodity prices), while the list of discrete events include anything else (regulatory changes, political instability, natural disasters, and transportation disruptions). Which goes which is perhaps not so important here, what matters is that continuous risk can be modelled and predicted, while discrete events can not. Continuous risks can be mitigated, discrete events can be prepared for.

The model

I did enjoy the model they set up, where they show how a supply chain, with its inherent supplier attributes and based on a company’s chosen supply chain strategy and structure, is exposed to endogenous and exogenous uncertainties, possibly leading to a supply chain disruption. In my usual manner I tried to make my own version of the original figure:

Click image for larger version

Critique

This is a well-written and well-researched paper, but there are a few things that have puzzled me when reading it. While the separation in endogenous and exogenous uncertainty makes perfect sense, I fail to see why there is a distinction between discrete and continuous risk only in the exogenous uncertainty, but not in the endogenous uncertainty. The endogenous uncertainty is divided into market turbulence and technology turbulence; this too makes perfect sense, but why is there no turbulence in the exogenous uncertainty? In addition, for an article written in 2008, the impressive reference list seems to be lacking many of the – in my humble opinion – now seminal works on supply chain risk, two of which I mentioned above.

Conclusion

Turbulent environments. Or is it just uncertain environments? IMHO, uncertain environments. Using turbulent/turbulence has not added anything new, except perhaps a greater degree of volatility. That said, what has added something new is the clear division between endogenous and exogenous and the division between continuous risk and discrete events. It has also made clear that the outside and inside risks need to be addressed differently, based on a contingency approach. In final conclusion, it is a noteworthy paper.

Reference

Trkman, P., & McCormack, K. (2009). Supply chain risk in turbulent environments—A conceptual model for managing supply chain network risk International Journal of Production Economics, 119 (2), 247-258 DOI: 10.1016/j.ijpe.2009.03.002

Author links

- linkedin.com: Peter Trkman

- drkresearch.org: Kevin Mc Cormack

A second opinion

David Stengel of the SCRM Blog has written his own review of supplier selection in a turbulent world, where he discusses the pros and cons of Trkman’s framework, with cons list considerably longer than the pros list.

- scrmblog.com: Supplier Selection in a Turbulent World

Related

- husdal.com: Catastrophic events in supply chains

- husdal.ccom: What’s so special about this Paul Kleidorfer?