Disasters. The result: Damaged infrastructure. End result: Disrupted supply chains. But how do disasters really impact supply chains? What is the supply chain risk of disasters? While the damage done by windstorms and floods may be different from that of an earthquake, do they also impact supply chains differently, and does it even differ by industry or sector? Is it different upstream or downstream the supply chain? According to what Nesih Altay and Andres Ramirez wrote in their very recent article Impact of disasters on firms in different sectors: Implications for supply chains, the kind of disaster and the place a company has in the supply chain matters considerably. Interestingly, so they say, upstream partners enjoy a positive impact, while downstream partners have to plan for the opposite.

Disasters. The result: Damaged infrastructure. End result: Disrupted supply chains. But how do disasters really impact supply chains? What is the supply chain risk of disasters? While the damage done by windstorms and floods may be different from that of an earthquake, do they also impact supply chains differently, and does it even differ by industry or sector? Is it different upstream or downstream the supply chain? According to what Nesih Altay and Andres Ramirez wrote in their very recent article Impact of disasters on firms in different sectors: Implications for supply chains, the kind of disaster and the place a company has in the supply chain matters considerably. Interestingly, so they say, upstream partners enjoy a positive impact, while downstream partners have to plan for the opposite.

Not a case for case studies?

Many researchers and practitioners have focused the intra-firm or intra-chain effects of supply chain disruptions, but little research exists on global or system-wide impacts both upstream and downstream, and the authors lament that only very few publications address this issue. There is a thus need for a better understanding of how disasters impact on supply chains. Now, doing a case study on how disasters affect supply chains is perhaps not the most viable option. First of all, you have to be there when it happens, and when it does, the company affected is probably not too happy about having to entertain researchers while dealing with the crisis. In their exploratory study the authors thus use secondary databases of firm and disaster data in order to analyze the impact of over 3,500 disasters on more than 100,000 firm-year observations over 15 years. If that isn’t sufficient I don’t know what would be. Unsurprisingly, they find that disasters impact all sectors within a supply chain.

Damage proxies

How does one compare disasters, let alone supply chain impacts? As all countries (and impacts) are different, simply counting event frequencies, number of people affected or the value of property damage is meaningless for cross-country comparisons. The key issue is to find the right measure to evaluate disaster damage:

The number of events at a location does not necessarily translate into actual damage experienced. Frequent events striking a sparsely populated area may not cause significant damage to the local economy […] If a disaster affects a considerably large portion of the population in a country, it has the potential of disturbing the availability and productivity of the labor force even when little physical damage is created.

Consequently, a better approximation is to normalize the values:

aff/pop – the ratio of the total people affected by disasters by year of the population of the country

dam/gdp – the ratio of yearly monetary damages over the total GDP of the country

Even so, these values are still wrought with potential problems, the authors say, which is why the suggest a composite measure:

composite =

[(0.25 x aff/pop) + (o.25 x k/pop)

+ (o.25 x count ) + 0.25 x dam/gdp)]

Here, k is the number of people killed per year in disaster events and count is the annual frequency of events.

Three hypotheses

Using three financial performance measures the authors set up three hypotheses for how firms in a given sector are affected by a disaster:

1. A firm’s financial leverage (FL) increases in response to a disaster.

Reason: The loss of capital and durable goods may lead firms to borrow capital, and consequently the financial leverage of firms should increase shortly after the disaster.

2. A firm’s total asset turnover (TAT) will decrease in response to a disaster.

Reason: If a natural disaster damages equipment and assets, all replacements and repairs will be added to its value, thus pushing the TAT lower.

3. A firm’s operational cash flow (OCF) will increase in response to a disaster.

Reason: If reconstruction efforts increase local economic activity, this should reflect positively on the firm’s OCF.

To test the hypotheses a fixed-effect regression is utilized.

Regression model

For the statisticians among my readers, here is the regression model with explanatory and control variables:

OP_Cashflowict = α + β1 Extractct

+ β2 Manufacturingct + β3 Wholect

+ β4 Retailct + ΓFirmict + ΦCountryct + ectFLict = α + β1 Extractct

+ β2 Manufacturingct + β3 Wholect

+ β4 Retailct + ΓFirmict + ΦCountryct + ectTATict = α + β1 Extractct

+ β2 Manufacturingct + β3 Wholect

+ β4 Retailct + ΓFirmict + ΦCountryct + ect

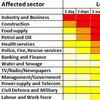

The subscript ict refers to firm i in country c in year t. Extract (representing raw material supply), Manufacturing, Whole (representing wholesale) and Retail are the main explanatory variables, equalling a company’s place in the supply chain (upstream or downstream). Each variable is the product of a disaster damage proxy (dam/gdp, aff/pop, composite) times a dummy variable for the specific firm-year observations belonging to the particular sector (zero if no damage, one if damage). Country-level controls include GDP per capita, relative size of banking sector, country risk and corruption. Firm-level controls include growth opportunities size, non-debt tax shields, business risk, cash holdings and tangibility of assets.

Data sources

Disaster data are compiled from EM-DAT, while firm-level data stems from Worldscope. Worldscope provides annual and interim/quarterly data, detailed historical financial statement content, per share data, calculated ratios, pricing and textual information of 57,000 companies with up to 20 years of historical data available. EM-DAT is an Emergency Events Database maintained by the WHO Collaborating Centre for Research on the Epidemiology of Disasters (CRED) and contains essential core data on the occurrence and effects of over 18,000 mass disasters in the world from 1900 to present.

Windstorms, floods and earthquakes

Although the EM-DAT database lists disasters in three categories, natural, technological, and conflict, the authors chose to use only natural disasters. Furthermore, they selected only events with a sudden onset and not events that develop over an extended period, such as drought and famine. Mud slides, volcano eruptions, wildfires, waves and surges, and extreme temperatures were excluded, and only earthquakes, floods and windstorms made it into the analysis. The authors say this is because windstorms and floods are the most common occurrences and because earthquakes because they create the highest damage. While I would have liked to see other disasters included in the analysis as well, it is evident from the analysis results that disasters do impact all parts of the supply chain, and that the impact does differ depending on the company’s industry sector and place in the supply chain.

Critique

This paper impresses me. Most of all because the authors have sifted through tons of data and arrived at three important contributions to the literature:

- different natural disasters impact different echelons of the supply chain differently

- disaster mitigation strategies need to be disaster-specific, not an all-hazard approach

- composite disaster impact measures work better than single measures

Moreover, they are acutely aware of the limitations of their conclusions; both are discussed in great detail in the paper. Finally, the future research suggestion is particularly fruitful, and not just some smalltalk paragraph added for the sake of having one. Here they suggest, among others, to

- investigate the impact of disaster disruptions on supply chain “services” such as transportation, telecommunications, information technology and financial services

- investigate the long-term effect of supply chain disasters, as displayed in Sheffi’s resilience curve

- investigate pre-event impacts of supply chain disasters in companies located in disaster-prone areas

Given the thoroughness of the research and the novelty of using secondary data to such a degree, I do believe that this paper will stand the test of time and be frequently cited by future researchers, as well as providing much inspiration for future research.

Reference

ALTAY, N., & RAMIREZ, A. (2010). IMPACT OF DISASTERS ON FIRMS IN DIFFERENT SECTORS: IMPLICATIONS FOR SUPPLY CHAINS Journal of Supply Chain Management, 46 (4), 59-80 DOI: 10.1111/j.1745-493X.2010.03206.x

Author links

- linkedin.com: Nezih Altay

- linkedin.com: Andres Ramirez

Related links

- scdigest.com: The top 11 supply chain disasters (pdf)

Related posts

- husdal.com: Pyramidal thoughts

- husdal.com: When disaster strikes