Some of you may remember that I posted about the SCOR Framework for Supply Chain Risk Management earlier this year, and today I will take a closer look at it again, because I recently found a post on scdigest.com, where Mitul Shah, one of the key members of the working group behind the framework, explains how this risk management framework can be put into use to calculate the Value-at-Risk (VaR). This Value-at-Risk is an important construct in estimating the economic implications of supply chain risks and in implementing the best strategies for supply chain risk management. This post is based on those three posts and my personal communications with Mitul Shah, Manager at Accenture Consulting.

Some of you may remember that I posted about the SCOR Framework for Supply Chain Risk Management earlier this year, and today I will take a closer look at it again, because I recently found a post on scdigest.com, where Mitul Shah, one of the key members of the working group behind the framework, explains how this risk management framework can be put into use to calculate the Value-at-Risk (VaR). This Value-at-Risk is an important construct in estimating the economic implications of supply chain risks and in implementing the best strategies for supply chain risk management. This post is based on those three posts and my personal communications with Mitul Shah, Manager at Accenture Consulting.

Value-at-Risk

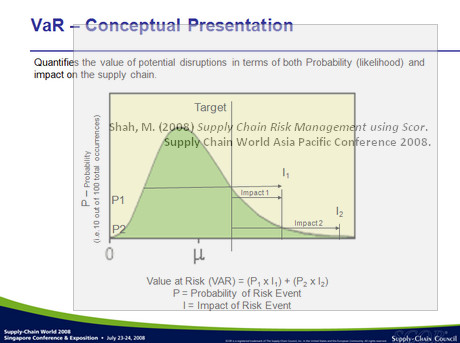

Although it is only recently that I found the post about Value-at-Risk on scdigest.com, the post itself is not so recent, as it was published more than a year ago, in August 2009. Value-at-Risk (VaR) has its origins in the finance industry, where it is used to understand the risk exposure of a trading portfolio based on historic volatility. Aptly titled Talking Supply Chain Risk in a Language Everyone Understands – Money!!, Mitul Shah shows how VaR is an easy-to-understand representation of supply chain risk in monetary value, thus providing the necessary leverage for investment, as VaR provides a monetary estimate of the potential loss if the risk goes untreated.

SCOR Risk Assessment

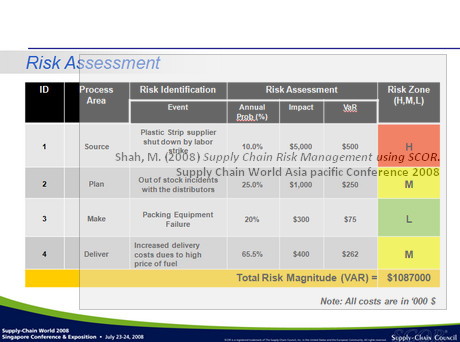

SCOR is a process reference model for supply chain management, spanning from the supplier’s supplier to the customer’s customer, where the end-to-end supply chain is governed by 5 distinct management processes: Plan, Source, Make, Delive rand Return. For each process it is possible to assess the probability of disruptions and the economic consequences, should the disruption occur, and thus calculate the Value-at-Risk as a product of probability and impact:

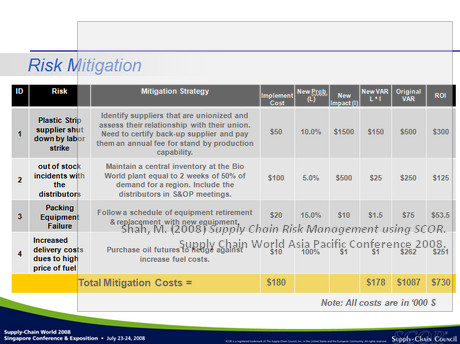

SCOR Risk Mitigation

The next step is to assess the return on investment (ROI) for the selected mitigation strategies, by recalculating the new VaR based on the new impact and the new probability:

Useful?

Some risk assessments rely on more descriptive values, e.g. probability ranging from very low to very high, and consequences ranging from none to severe; this makes different risks very difficult to compare. A monetary value is easier to understand, and Value-at-Risk is a metric that can assist companies in estimating potential losses related to risks in the supply chain and estimating the potential benefits related to mitigation measures. For all its simplicity, there are some caveats to using this method. In particular, the accuracy of VaR depends on the accuracy of the underlying values, i.e. probabilities and consequences. In real life, neither probabilities nor consequences tend to behave the way they are assumed to behave; they are very difficult animals to tame. It should be kept in mind that these are estimates only, not absolutes. That said, Value-at-Risk is an excellent tool for decision-making related to risk, and for weighing costs against benefits.

Links

- scdigest.com

- linkedin.com

- supply-chain.org

- Managing Risk with SCOR (project report, pdf)

Reference

Shah, M. (2008) Supply Chain Risk Management Using SCOR. Supply Chain World Asia Pacific Conference 2008, 23 – 24 July 2008, Singapore

Related

On a side note, and quite interestingly, the risk perspective used in the SCOR Supply Chain Risk Management framework has found its way into an international standard, ISO 28002 – Security management systems for the supply chain, something I wrote about last week.