In September and October 2009 the Economist Intelligence Unit surveyed 500 company executives with responsibility for risk management, and selected from companies across Asia-Pacific, North America and Europe, in order to understand how companies are being affected by supply-chain risk, and how they are responding to it. While colored by the them still lingering recession, and perhaps already as old as the proverbial water under the bridge, the report titled Managing supply chain risk for reward nonetheless paints a good picture of what supply chain risks these executives think thought are were the most pressing issues in their industry. This post will highlight some of the findings from the report, even though things may have changed in the meantime…

In September and October 2009 the Economist Intelligence Unit surveyed 500 company executives with responsibility for risk management, and selected from companies across Asia-Pacific, North America and Europe, in order to understand how companies are being affected by supply-chain risk, and how they are responding to it. While colored by the them still lingering recession, and perhaps already as old as the proverbial water under the bridge, the report titled Managing supply chain risk for reward nonetheless paints a good picture of what supply chain risks these executives think thought are were the most pressing issues in their industry. This post will highlight some of the findings from the report, even though things may have changed in the meantime…

The highlights

So then, a little less than two years ago, what was keeping executives up at night? Below is a short summary of the questions and the replies, where I have cited the three top items and the three bottom items. You can read the full list in the report that you download below.

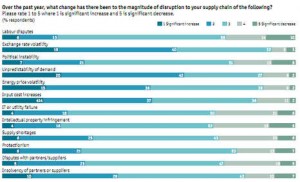

Over the past year, what has contributed most to the magnitude of disruption to your supply chain?

- Unpredictability of demand

- Exchange rate volatility

- Energy price volatility

- …

- Disputes with partners/suppliers

- IT or utility failure

- Intellectual property infringement

Over the next year, which of the following do you see as the biggest threats to the resilience of your supply chain?

- Unfavourable exchange rate movements

- Input price increases

- Energy price increases

- …

- Theft

- Product tampering

- Disruption from unknown third-parties to supply chain

Which of the following steps has your organisation taken in the past 12 months as a result of the current downturn?

- Negotiated lower prices from suppliers

- Increased efficiency of logistics

- Increased use of outsourcing

- …

- Increased prices to customers

- Reduced capacity levels

- No particular steps

Which of the following are exerting pressure on your company to increase its supply chain resilience?

- Executive management

- Customers

- Own business units and staff

- …

- Suppliers

- Non-executive management

- Logistics providers

Over the next 12 months, what do you see as the biggest obstacles to improved supply chain risk management?

- Concerns about increased costs and redundancy

- Underestimation of potential impact of supply chain risks

- Poor communication across supply chain

- …

- Inadequate technology

- Excessive focus on efficiency

- No representation of supply chain at board level

Which of the following steps are you currently taking to increase the resilience of your company’s supply chain?

- Improve collaboration with suppliers and partners

- Shift from single to multiple supplier base

- Streamline processes

- …

- Introduce supply chain event management system

- Increase capacity levels

- Nothing—resilience is not a concern

As I said above, this was written two years ago, and perhaps it is already outdated and no longer valid, but I’m not so sure. That said, how would you answer the questions above?

Related link

- acegroup.com: Managing supply chain risk for reward

Related posts

- husdal.com: Stemming the rising tide of supply chain risks

- husdal.com: The supply chain of the future