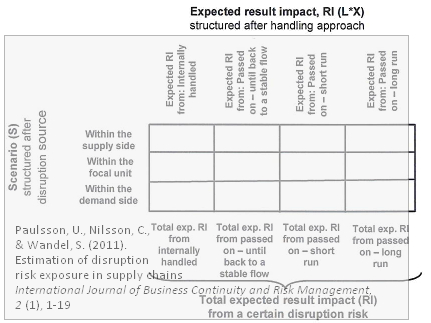

How to estimate the disruption risk exposure in a supply chain? That is the question asked by Ulf Paulsson, Carl-Henric Nilsson and Sten Wandel in their paper titled Estimation of disruption risk exposure, building on what Paulsson wrote in his PhD on the same subject. Here they develop a model that links disruption risk to disruption source, covers all flow-related disruption risks in the total supply chain from natural resources to delivered final product, seen from the angle of an individual focal unit in the supply chain. The model classifies the risk exposure into 15 different risk exposure boxes, of which 12 have ‘expected result impact’ and three have ‘known result impact’, providing what they call a total negative result impact.

How to estimate the disruption risk exposure in a supply chain? That is the question asked by Ulf Paulsson, Carl-Henric Nilsson and Sten Wandel in their paper titled Estimation of disruption risk exposure, building on what Paulsson wrote in his PhD on the same subject. Here they develop a model that links disruption risk to disruption source, covers all flow-related disruption risks in the total supply chain from natural resources to delivered final product, seen from the angle of an individual focal unit in the supply chain. The model classifies the risk exposure into 15 different risk exposure boxes, of which 12 have ‘expected result impact’ and three have ‘known result impact’, providing what they call a total negative result impact.

How to handle a supply chain disruption?

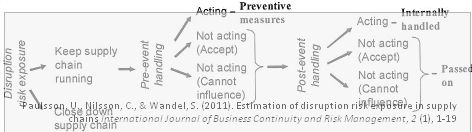

one of the ideas from this article that I like very much are the different alternatives for handling a supply chain, basically only two: to act or not to act, that is the question.

These two options start from the very first signs of disruption: To act: close down the supply chain, or not to act: keep the supply chain running.

The same goes for pre-event measures, or mitigative measures as I like to call them. Here, to act means trying to prevent disruptions from happening, while not to act mens either to accept the disruption and its consequences despite possible actions that could be taken, or to accept the disruption because it can neither be influenced as to probability nor as to consequence.

Similarly, when it comes to post-event measures, or contingent measures as I would call them, there is again the option of acting or handling internally or not acting or passing on the event and it s consequences.

Going with the flow

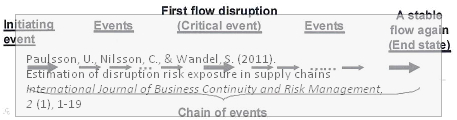

Another interesting though from this paper is the supply chain flow, and where the purpose of handling supply chain disruptions is to regain a stable flow in both incoming, outgoing and internal flows.

Furthermore, regaining a stable flow after a supply chain disruption also implies short-term stability or market patience while the disruption is handled and long-term stability or market confidence after an event has been handled.

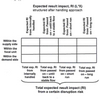

Total expected result impact

Combining the disruption handling options, the types of flows and the chain of events creates twelve possible combinations of impacts which must be added in order to obtain the total expected result impact:

This splits the disruption impacts into individual units while at the same time keeping the full picture intact.

Conclusion

What I like about the model developed in this paper is that addresses the entire supply chain from supplier until end customer. It is a holistic and generic model for estimating disruption risks in the supply chain flow in a systematic and structured manner. The model presents, as far as I can see, the most complete estimation of disruption risks, it includes incoming and outgoing flows and it separates between mitigative and contingent handling of disruptions, thus balanacing proactive and reactive risk management.

Reference

Paulsson, U., Nilsson, C., & Wandel, S. (2011). Estimation of disruption risk exposure in supply chains International Journal of Business Continuity and Risk Management, 2 (1) DOI: 10.1504/IJBCRM.2011.040011

Author links

- lu.se: Ulf Paulsson

- linkedin.com: Carl-Henric Nilsson

- linkedin.com: Sten Wandel

Related posts

- husdal.com: Ulf Paulsson’s DRISC model

- husdal.com: Inbound and outbound vulnerability