I could have just re-used the title on my post on risks in supply networks from a couple days ago and called this post “Another tale of principals and agents”, but it’s not that simple. In Risk assessment and relationship management: practical approach to supply chain risk management, Ritchie, Claire & Armstrong (2008) do use the principal-agent theory, but their main issue is the introduction of a new term: risk portfolio management.

I could have just re-used the title on my post on risks in supply networks from a couple days ago and called this post “Another tale of principals and agents”, but it’s not that simple. In Risk assessment and relationship management: practical approach to supply chain risk management, Ritchie, Claire & Armstrong (2008) do use the principal-agent theory, but their main issue is the introduction of a new term: risk portfolio management.

Confusion, confusion, confusion

Supply Chain Risk Management (SCRM) is still in its infancy and there is still some, or rather, much divergence as to a common theme in the academic literature. More recently, SCRM appears to be moving away from the more mundane day-to-day tasks of operations and logistics and towards strategies, corporate management and relationships. Finally, a holistic management aspect of SCRM appears to be gaining the upper hand, and today’s article is a perfect example of that.

The risk portfolio

Already in the introduction the authors set out a new direction for SCRM:

Supply Chain Risk Management is crucially viewed as a portfolio of decisions, recognizing that supply chain decision makers manage simultaneously a multiple set of risk encounters, rather than serially addressing single dyadic interfaces.

Why is this important? Because SCRM needs to address the whole supply chain, since risk can emanate from any part of the supply chain and potentially affect the performance of the entire supply chain.

Three dimensions of risk

The authors define risk as a function of

- The likelihood of the occurrence of a particular event

- The consequences of the particular event

- The sources and causal pathways leading up to the event

Many other authors have used the same or similar definitions of risk, e.g. Jüttner, Peck and Christopher (2003)in Supply Chain Risk Management: Outlining an Agenda for Future Research, or Paulsson in The DRISC Model, recognizing that risk is not something that is either present or not, but needs a catalyst (a source) and an impact (consequence) in order to be fully described.

The Supply Chain Risk Management Framework

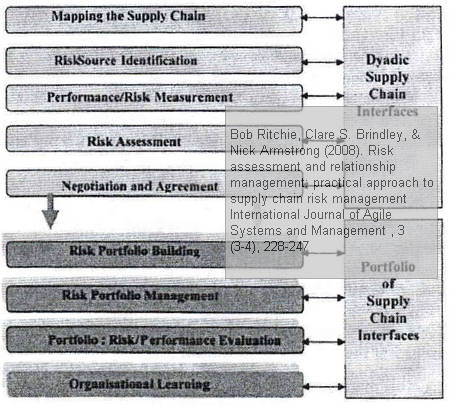

Each dyadic relationship is fed into the portfolio as follows:

- Dyadic Supply Chain Interface

- Mapping the Supply Chain

- Identifying the Risk Source

- Develop a Risk/Performance Measurement

- Assess the Risk

- Negotiate and Agree on how the risk is shared

- Portfolio of Supply Chain Interfaces

- Build a Risk Portfolio

- Manage the Risk Portfolio

- Evaluate Risk/Performance for the Portfolio

- Feed this back into Organizational Learning

I’m not sure whether the aggregation of individual dyadic risks into a portfolio can under-emphasize (read: neglect or ignore) certain dyadic risks.

Nonetheless, the overall balance is what is important here. Besides, the crucial part of this framework is actually the feedback loop into the organization.

Principals’ and agents’ perspectives

Based on their research, the authors develop seven propositions, three for principal and agent respectively and and one shared for both:

- The principal needs to plan and manage the performance/risk portfolio in aggregate, while balancing the distribution of risk/performance and keeping in mind both the short term and the long-term perspective.

- The governance of the supply chain relationship requires continuous monitoring of the individual risk seen against the overall risk in the portfolio.

- As the relationship matures, performance measuring is replaced by relationship nurturing.

- The agents in managing their own performance and risk need to recognize the general needs of the principal and the approaches he employs as to monitoring and measuring their performance.

- Success in managing supply chain performance and risk is dependent on the ability to reach a common shared position on expected performance, risk and risk sharing.

- Supply chain management operates in a highly dynamic environment which must be reflected by the management structures, processes and systems.

- Developing sound supply chain interfaces can lessen the complexity of the supply chain and reduce the uncertainty of unpredictable risk/performance outcomes.

Conclusion

The authors are right in pointing out that SCRM must address the supply chain as a whole, and not only operations and/or individual supplier-buyer relationships, but must address the full portfolio of risks. That is only possible if principal and agent engage in building and maintaining an intimate relationship.

Reference

Bob Ritchie, Clare S. Brindley, & Nick Armstrong (2008). Risk assessment and relationship management: practical approach to supply chain risk management International Journal of Agile Systems and Management , 3 (3-4), 228-247 DOI: 10.1504/IJASM.2008.021211

Links

- linkedin.com: Professor Clare Brindley

- linkedin.com: Professor Bob Ritchie

Related

- husdal.com: Risks in Supply Networks