Have the prices gone up at your local supermarket recently? Maybe your favorite chocolate is suddenly a lot more expensive? Do you wonder why? You may not think much about it, but the bigger picture that lays behind is grim-looking, to say the least: Cocoa trading at a one-year high, coffee trading a 13-year high, sugar trading at a 30-year high…ouch! I didn’t know there were such fluctuations in the raw material prices of the staples that go into so many of today’s foods, and if these prices continue to go up, that will definitely feed through the entire food supply chain, let alone the economy. Is cheap food and cheap energy perhaps a thing of the past and a time gone by?

Have the prices gone up at your local supermarket recently? Maybe your favorite chocolate is suddenly a lot more expensive? Do you wonder why? You may not think much about it, but the bigger picture that lays behind is grim-looking, to say the least: Cocoa trading at a one-year high, coffee trading a 13-year high, sugar trading at a 30-year high…ouch! I didn’t know there were such fluctuations in the raw material prices of the staples that go into so many of today’s foods, and if these prices continue to go up, that will definitely feed through the entire food supply chain, let alone the economy. Is cheap food and cheap energy perhaps a thing of the past and a time gone by?

Blame it on the weather

You could blame recent disasters like the Australian flooding for the hike in sugar prices, as was debated in a lengthy post titled Queensland could transform our view on commodities that I found on the Tranformational Logistics blog, but disasters decimating crops are only part of the picture. More to blame (although “blame” is obviously the wrong word here) are the emerging economies and their rising demand for food, and that is not going to slow down.

Not looking good

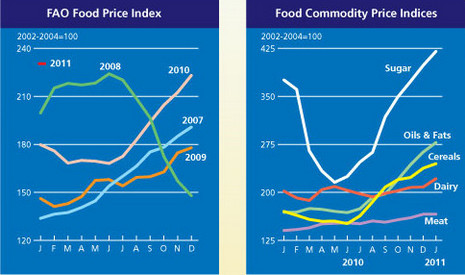

Looking at the World Food Situation index provided by the UN or FAO to be exact, the picture is grim: Food prices have more than doubled since 2002. In industrialized countries it is estimated that people spend less some 10-15% of their monthly income on food. Double the price, and the impact is still manageable. However, in many emerging and developing economies, people spend 50% or even more on food. Double the prices here and you will have a social crisis at your hands. As a matter of fact, that is why so many countries are subsidizing certain staple items.

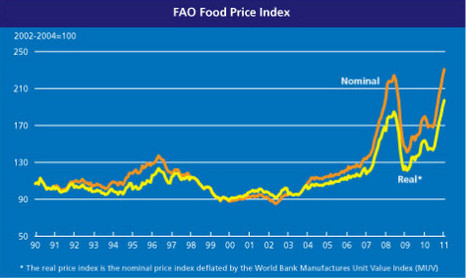

Interestingly, if you look at the food prices in a longer historical perspective, the rise is even more frightening, looking perhaps a bit like Al Gore’s hockey stick of global warming:

Will it go down again? In my personal opinion, no. I think that the food supply chain and the security of supply will be one of the hottest supply chain trends in years to come.

Will it go down again? In my personal opinion, no. I think that the food supply chain and the security of supply will be one of the hottest supply chain trends in years to come.

The price we pay

I guess it’s no coincidence that the soft commodity crunch is making rounds on CNN’s Quest Means Business these days. In fact, CNN has just launched a year long series titled “The Price We Pay”, where they will examine in-depth the factors and direct impact of global price instability around the world and how the growing imbalance of supply and demand will affect each and everyone of us.

Not just food

In 2010, for the first time, more cars were sold in China than in the US. That hasn’t happened since Henry Ford introduced his Ford Model T some hundred years ago. And China has now overtaken Japan as the world’s second largest economy and is poised to surpass the US in 15 years or so or maybe even less. India is the runner up and may overtake Japan in 25 or so years. Now, what will that do the world’s food and energy reserves?

Related posts

- husdal.com: Security of supply